The insurance industry is facing a seismic shift. According to McKinsey, 75% of insurance agents report struggling to meet their sales targets due to a rapidly changing market and evolving customer demands*.

This is a wake-up call for insurance companies—if your sales training isn't keeping up, your agents may be falling behind.

Are your agents equipped to handle the modern demands of the customer? Do they struggle to convert leads into sales in an increasingly competitive marketplace?

How can your company stay ahead of the curve in this digital-first age?

Sales training has never been more critical, but traditional methods are no longer enough. AI-powered coaching offers a proven solution, with research showing that AI can boost agent productivity.

It's time to stop relying on outdated methods and embrace innovation. AI not only enhances skills but tailors coaching to each agent's unique strengths and weaknesses. As competition intensifies and customer expectations rise, can you afford to leave your agents behind?

In this blog post, we will explore the current state of sales training in the insurance industry, address the challenges companies face, and reveal how AI-powered coaching can propel your team toward success.

The future of your insurance salesforce starts now—let’s dive in!

The current state of sales training for insurance companies

Insurance sales training programs today are designed to address the specific needs and challenges faced by insurance agents. There is an increasing emphasis on adopting a more consultative and customer-centric approach, moving away from traditional transactional methods.

This shift requires agents to act as trusted advisors, understanding their clients' unique needs and providing personalized solutions.

These programs often focus on developing essential skills such as:

- Product knowledge: Agents need a deep understanding of various insurance products, their features, benefits, and exclusions to effectively address customer needs.

- Sales techniques: Training programs cover various sales techniques, including consultative selling, needs analysis, and closing strategies, to help agents effectively engage with customers and close deals.

- Communication skills: Effective communication is crucial for building rapport, understanding customer needs, and presenting solutions convincingly. Training programs emphasize active listening, clear articulation, and persuasive communication techniques.

- Technology proficiency: With the increasing use of digital tools in insurance sales, agents need to be proficient in using CRM systems, online prospecting tools, and other technologies that streamline the sales process.

- Compliance and ethics: Insurance is a highly regulated industry, and agents must be trained on relevant laws, regulations, and ethical sales practices to ensure compliance and maintain industry standards.

Many insurance companies recognize the importance of continuous training to keep their salesforce up-to-date with industry trends, product knowledge, and evolving customer expectations.

Challenges and opportunities in sales training for insurance companies

While sales training is crucial, insurance companies face various challenges in designing and implementing effective programs. Some of the key challenges include:

- High employee turnover: The insurance industry often experiences high employee turnover, which can result in wasted training resources and inconsistent sales performance.

- Budget constraints: Training budgets can be limited, especially for smaller agencies, making it challenging to invest in high-quality programs and technologies.

- Lack of engagement: Keeping agents engaged during training can be difficult, especially with traditional training methods.

- Measuring effectiveness: It can be challenging to measure the effectiveness of training programs and demonstrate a return on investment.

- Digital transformation: The impact of technological advancements on insurance marketing strategies requires agents to adapt to new tools and approaches. Failure to embrace digital transformation can lead to a competitive disadvantage.

- Regulatory and compliance complexities: Insurance is subject to various regulations and compliance requirements, which can vary from state to state. Training programs need to address these complexities and ensure agents are well-versed in the applicable rules and guidelines.

- Developing "Decision Coaches": Insurance sellers need to develop the skills to become "decision coaches" or "counselors" for their clients. This involves mastering prospecting techniques, understanding client needs, and building trust to guide clients towards informed decisions.

However, these challenges also present opportunities for insurance companies to innovate and improve their sales training approaches. By leveraging technology, personalizing training programs, and adopting a data-driven approach, companies can overcome these challenges and achieve better training outcomes.

Different types of sales training available for insurance companies

Insurance companies can choose from various types of sales training programs to meet their specific needs and preferences.

Some common delivery methods include:

Delivery formats

There are three main ways that sales training can be delivered:

- In-person: Traditional in-person workshops and seminars offer a structured learning environment with face-to-face interaction and hands-on activities. This format allows for direct engagement with instructors and peers, fostering collaboration and immediate feedback.

- Online with a facilitator: This approach combines the flexibility of online learning with the guidance of a facilitator. Virtual instructor-led training (VILT) sessions allow for real-time interaction and personalized instruction, while also providing the convenience of remote access.

- Online without a facilitator: Self-paced e-learning courses and modules provide agents with the autonomy to learn at their own pace and access training materials anytime, anywhere. This format is often more cost-effective and can be easily scaled to accommodate large teams.

Training methods

In addition to the delivery formats, various training methods can be employed:

- In-person workshops: Traditional in-person workshops provide a structured learning environment with face-to-face interaction and hands-on activities.

- Virtual instructor-led training (VILT): VILT offers the flexibility of online learning while maintaining the interactive element of instructor-led sessions.

- E-learning: Online courses and modules allow agents to learn at their own pace and access training materials anytime, anywhere.

- Blended learning: This approach combines different training methods, such as online modules, in-person workshops, and coaching sessions, to provide a comprehensive learning experience.

- AI-powered sales coaching: AI-powered platforms offer personalized coaching, real-time feedback, and performance analysis to enhance sales skills and improve customer interactions.

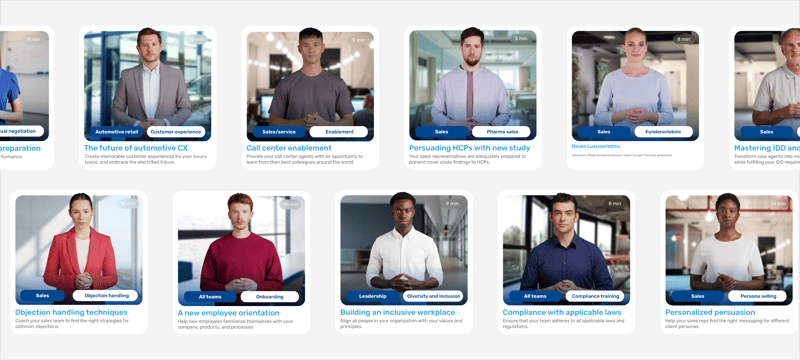

- Simulations: Simulations provide agents with hands-on practice in a safe environment. They can experience realistic sales scenarios, practice handling objections, and refine their communication skills without the pressure of real-world interactions.

- On-demand support: Access to on-demand support resources, such as knowledge bases, FAQs, and online forums, allows agents to receive continuous learning and assistance even after completing formal training programs.

Specialized training areas

- Emotional intelligence: Emotional intelligence training helps agents develop essential skills such as empathy, self-awareness, and adaptability. These skills are crucial for building strong client relationships, understanding their needs, and navigating complex sales situations.

- Insurance loans and financial products: Agents need to be knowledgeable about various insurance loans and financial products to provide comprehensive advice to their clients. Training in this area covers topics such as types of insurance loans, loan terms, interest rates, tax implications, and long-term financial planning options.

- Insuretech: With the increasing use of technology in the insurance industry, agents need to be proficient in using digital tools for policy management, claims processing, and customer insights. InsureTech training equips agents with the necessary skills to leverage these technologies effectively.

The choice of training method depends on factors such as budget, learning styles, and the specific needs of the sales team.

Benefits of using AI-powered sales coaching for insurance companies

AI-powered sales coaching is transforming the way insurance companies train their agents. These platforms leverage artificial intelligence to provide personalized feedback, analyze performance data, and offer real-time guidance during customer interactions.

Some key benefits of AI-powered sales coaching include:

- Personalized learning: AI algorithms analyze individual performance data to identify areas for improvement and provide tailored coaching recommendations. This personalized approach ensures that agents receive training that is relevant to their specific needs and learning styles.

- Improved engagement: Interactive simulations and gamified learning environments keep agents engaged and motivated to learn. AI-powered platforms can also provide personalized challenges and rewards to further enhance engagement.

- Increased efficiency: AI automates tasks such as performance tracking and feedback delivery, freeing up managers to focus on more strategic activities. This automation also ensures that feedback is consistent and objective, reducing bias and improving fairness.

- Data-driven insights: AI-powered platforms provide valuable insights into sales performance, helping managers identify trends, track progress, and make informed decisions. These insights can be used to optimize training programs, identify top performers, and address areas where agents need additional support.

- Enhanced customer interactions: Real-time guidance and feedback during customer interactions help agents improve their communication skills and close deals more effectively. AI can analyze customer sentiment and provide agents with prompts and suggestions to enhance their conversations.

- Increased personalization: AI plays a crucial role in enabling personalized sales training and customer interactions. By analyzing vast amounts of data, AI can identify patterns and segment customers into hyper-specific groups. This allows sales teams to tailor their communication styles, offers, and recommendations to individual needs and preferences, leading to increased customer satisfaction and conversion rates.

- Improved employee retention: Personalized training and support through AI-powered coaching can contribute to increased job satisfaction and reduced employee turnover. By providing agents with the tools and resources they need to succeed, AI coaching fosters a sense of value and empowerment, leading to greater engagement and loyalty.

Implementation of AI-Powered sales coaching for insurance companies

Implementing AI-powered sales coaching requires careful planning and execution. Here are some key steps involved in the implementation process:

- Define objectives: Clearly define the goals and objectives of implementing AI-powered coaching. What specific challenges are you trying to address? What key performance indicators (KPIs) do you want to improve?

- Choose the right platform: Select a platform that aligns with your needs, budget, and technical capabilities. Consider factors such as the platform's features, ease of use, integration capabilities, and vendor support.

- Integrate with existing systems: Ensure seamless integration with your CRM, telephony, and other relevant systems. This integration allows for data sharing and automation, maximizing the platform's effectiveness.

- Provide training and support: Train your sales team on how to use the AI-powered coaching platform effectively. Provide ongoing support and resources to address any questions or challenges they may encounter.

- Monitor and evaluate: Continuously monitor the platform's performance, gather feedback, and make adjustments as needed. Track key metrics to measure the impact of the platform on sales performance and agent behavior.

Retorio's AI coaching platform can be a valuable tool in this context, offering personalized training experiences, skill development, and measurable results.

Here's a comprehensive approach, drawing from the provided documents:

1. Understanding the need for AI-powered sales coaching in insurance

- Adapting to market demands: The insurance industry faces evolving customer expectations and a competitive landscape. AI coaching helps insurance sales teams adapt quickly to market shifts by ensuring they are well-versed in product updates and can address customer concerns effectively.

- Developing essential skills: Many sales teams lack the skills needed to succeed in today’s challenging environment, including active listening, objection handling, and relationship-building. AI coaching offers a structured approach to upskilling teams by focusing on essential sales techniques and providing personalized feedback.

- Addressing training gaps: Traditional training methods often fall short due to slow ramp-up times, static modules, and limited scalability. AI coaching overcomes these limitations by providing real-time coaching for various situations, such as new product training, objection handling, and persona-specific strategies.

2. Key features of retorio’s AI coaching platform for insurance companies

- Personalized coaching Experiences: Retorio's AI coaching platform turns generic training into personalized coaching experiences. AI delivers immediate, personalized recommendations to help learners improve.

- Customizable AI avatars: Retorio enables the creation of lifelike AI avatars that behave like real stakeholders. This is achieved by turning persona sheets into AI avatars, giving them a personality, needs, and pain points.

- AI coaching content generator: This feature allows the creation of custom coaching simulations tailored to the sales process. By uploading new product information, the AI generates dynamic and interactive coaching sessions.

- Behavioral analysis: The AI coach analyzes sales reps' verbal and non-verbal behavior, delivering immediate, personalized recommendations aligned with established sales methods.

- Integration capabilities: The platform integrates with existing CRM and HRM systems, allowing for tailored coaching sessions based on team needs and market demands.

- Compliance focus: The platform is designed to learn from MLR-approved documents and can provide recommendations that are pre-approved by the MLR-team.

- Data-Driven insights: The platform provides tailored scorecards aligned with specific coaching goals to track learning progress. It also measures real behavioral improvements and validates coaching success with data-driven insights.

- Scalability: Retorio's AI coach can interact with thousands of reps simultaneously in a psychologically safe space.

3. Implementation steps for insurance companies

- Step 1: Goal setting and context definition:

- Define learning goals and upload scenario content. Identify key skills and behaviors to align with insurance sales processes.

- Determine specific areas for improvement, such as mastering responses to common customer concerns or improving communication with account payers.

- Step 2: AI-powered content creation:

- Upload relevant documentation, such as product sheets, compliance guidelines, and CRM data. The Retorio's AI generator will generate entire scenarios.

- Customize pre-existing frameworks and scorecards for different roles and target groups.

- Turn persona sheets into AI avatars to simulate interactions with various customer types.

- Step 3: Launching and engaging learners:

- Invite sales reps to engage with virtual customers and handle their objections and questions.

- Integrate AI coaching into existing workflows, such as the CRM system, to drive continuous participation.

- Use pre-suggested frameworks and best-practices for different roles and target groups.

- Step 4: Measuring and optimizing:

- Track learning progress with tailored scorecards aligned to specific coaching goals.

- Measure real behavioral improvements and validate coaching success with data-driven insights.

- Link leadership development to real business outcomes, ensuring training drives performance and growth.

- Monitor progress, measure, and report improvements to demonstrate the impact on behavioral level.

4. Addressing key challenges in insurance sales

- Objection handling: AI coaching can help insurance advisors master responses to common customer concerns with confidence.

- Persona-based selling: Adapt the sales approach to different customer personas.

- Regulatory compliance: Incorporate regulatory and compliance nuances into coaching programs.

- Building trust: Enable advisors to build powerful connections with stakeholders by transforming methodologies into scalable playbooks.

5. Benefits and expected outcomes

- Improved sales readiness: AI coaching can increase sales readiness by 20%.

- Faster ramp-up time: Reduce ramp-up time for new hires by 70%.

- Increased user activation: Achieve high user activation rates (80%) with AI coaching.

- Enhanced customer centricity: Improve customer centricity by +67%.

- Measurable ROI: Expect a 7-15x ROI in the first year.

6. Compliance and ethical considerations

- AI Act compliance: Ensure that the AI coaching platform complies with the AI Act, protecting the health, safety, and fundamental rights of individuals.

- Data privacy: Anonymize user data to comply with GDPR and other data privacy regulations.

- Transparency: Provide transparency in AI’s analysis and recommendations to build trust and confidence.

In today's fast-evolving business landscape, effective sales training is no longer a luxury—it's a necessity.

For insurance companies striving to stay ahead in an increasingly competitive market, AI-powered sales coaching is a game-changer.

Traditional training methods often fall short in delivering personalized, real-time feedback that truly drives performance improvement. Retorio's AI coaching platform revolutionizes sales training by offering an intelligent, data-driven approach tailored to each sales professional's unique needs.

Retorio's AI coaching platform provides a dynamic, immersive learning experience that empowers insurance sales teams to excel. Through advanced behavioral analysis, real-time coaching, and personalized learning paths, your agents can develop the communication, negotiation, and customer engagement skills necessary to close more deals with confidence. Unlike conventional training programs, which are often time-consuming and ineffective, Retorio integrates seamlessly into your workflow, enabling continuous learning without disrupting daily operations.

For L&D leaders and training managers in enterprise companies, the challenge is clear: How do you ensure your sales teams receive the right training, at the right time, in a way that leads to measurable results?

By leveraging AI to analyze sales interactions and provide instant, actionable feedback, your team can refine their skills in a real-world context, leading to tangible improvements in performance, customer satisfaction, and overall business success.

By implementing Retorio’s AI-powered sales coaching, you’re not just investing in training—you’re investing in a smarter, more agile, and future-ready sales force.

Discover how Retorio can help your insurance company drive performance and growth today.

FAQs for Sales training for Insurance companies

Insurance sales require mastering complex products, regulatory compliance, and empathetic customer interactions (e.g., discussing life insurance policies). Retorio’s AI simulations replicate industry-specific scenarios, like explaining coverage nuances or handling objections about premiums, ensuring reps build both technical and soft skills.

Retorio’s Solution: Customize simulations for scenarios like presenting to CFOs, navigating multi-stakeholder objections, or cross-selling policies. AI feedback focuses on consultative selling and compliance adherence.

Yes. Retorio’s AI Coaching Generator creates lifelike simulations for life insurance sales, such as:

-

Practicing empathetic conversations about beneficiaries.

-

Simplifying complex policy terms (e.g., whole vs. term life).

-

Overcoming objections like “I’m too young for life insurance.”

Absolutely. New agents use Retorio’s AI coaching platform to:

-

Role-play foundational skills (e.g., needs assessment, active listening).

-

Practice pitch delivery for different demographics.

-

Receive instant feedback on tone, clarity, and compliance.

Clients report 50% faster ramp-up for new hires.

Retorio combines industry-specific expertise with AI-driven personalization:

-

Custom Scenarios: Simulate niche situations like underwriting discussions or claims consultations.

-

Behavioral Analytics: Track empathy, trust-building, and compliance in customer interactions.

-

CRM Integration: Sync with tools like Salesforce Financial Services Cloud to trigger training during key workflows.

Yes. Retorio trains agents in multiple languages and adapts to regional regulations (e.g., EU’s IDD or U.S. state laws). Managers centrally monitor progress while ensuring localized relevance.

Retorio’s Impact Reporting tracks:

-

Policy conversion rates pre/post-training.

-

Compliance audit pass rates.

-

Customer satisfaction scores (e.g., post-call surveys).

One client saw a 35% increase in cross-selling after 3 months of Retorio training.

Yes. Retorio’s AI Coaching Generator lets you quickly modify scenarios to reflect new laws (e.g., ACA updates) or product launches, ensuring training stays current without costly manual overhauls.

Agents access Retorio’s simulations 24/7 via any device. For example, a remote agent practices handling a hurricane claim call with an AI avatar, receiving feedback on urgency and empathy.

Life insurance is notoriously tough due to sensitive conversations. Retorio helps agents:

-

Practice discussing mortality with AI avatars in a judgment-free zone.

-

Build trust through tone and empathy analytics.

-

Create urgency using compliant language (e.g., “Protect your family’s future now”).

etorio builds the 7 traits of top agents highlighted in industry guides:

-

People skills: Role-play client interactions to improve active listening.

-

Product knowledge: Simulate policy comparisons (e.g., term vs. whole life).

-

Honesty & urgency: Train agents to ethically create urgency (e.g., “What if something happens tomorrow?”).